"The Sovereign Individual" Investment Thesis

Globalization, Digital Money, & Dissident Technology

Information technology alters global power dynamics in a few key ways:

Instant information dissemination reduces commercial and jurisdictional barriers to entry and barriers to exit. This increases competition by facilitating global entrepreneurship.

The creation of non-sovereign, digital money decreases the power of inflation and taxation. Financial services can also more easily address the global market.

Encryption reduces the cost of protection and decreases the leverage of violence at scale. This leads to the rise of dissident technology.

Each of these categories represents a huge shift in society. They present massive opportunities. This post is an introduction into each of these changes and examines the source of user demand through the lens of the following human motivations:

Acquire (greed) – Desire to collect physical objects as well as immaterial ones like power, status, and influence

Defend (fear) – Desire to protect ourselves and our property

Bond (belonging) – Desire to form relationships

Learn (curiosity) – Desire to satisfy our innate curiosity

Feel (escape) – Desire for sensory stimulus and pleasure

Identifying investment opportunities through the lens of unchanging human motivations is inspired by Bezos’ excerpt:

“I very frequently get the question: 'What's going to change in the next 10 years?' And that is a very interesting question; it's a very common one. I almost never get the question: 'What's not going to change in the next 10 years?' And I submit to you that that second question is actually the more important of the two -- because you can build a business strategy around the things that are stable in time.”

Examining shifts in power dynamics helps us recognize overarching trends. Examining human behaviors within each trend helps us understand specific points of investment leverage.

While the set of human motivations is constant, the weighting of each changes based on environment.

“The lamb and the lion keep a delicate balance, interacting at the margin. If lions were suddenly more swift, they would catch prey that now escape. If lambs suddenly grew wings, lions would starve. The capacity to utilize and defend against violence is the crucial variable that alters life at the margin.”- The Sovereign Individual

Information technology has altered the balance between the lion and the lamb. It allows us to communicate and coordinate globally. Encryption allows us to store and protect assets against sophisticated attacks. For better or worse, commerce will increasingly be conducted outside the reach of governments’ protection. This increase in individual power will cause a shift in human behavior from “Acquire” to “Defend”. As the phrase goes, “With great power there must also come -- great responsibility.”

Theory of Change #1: Globalization is an equalizing force

Instant information dissemination reduces commercial and jurisdictional barriers to entry and barriers to exit. This increases competition by facilitating global entrepreneurship.

Almost all information is readily available online. Increasingly, commerce occurs online. Most work can be coordinated remotely.

This will likely lead to greater income equality between jurisdictions but potentially greater income inequality overall. Highly skilled entrepreneurs have unprecedented leverage to outperform, and unskilled workers have unprecedented, global competition for work. As someone raised in the United States where wage expectations are high, this idea can be unsettling and unpopular.

Competitive wages of remote work overpower jurisdictional boundaries and restrictions. With a diminishing importance on physical availability, the leverage governments have over their citizens decreases. Citizens increasingly become customers, and governments compete for their business. Look no further than the success of Singapore as an example of a highly favorable business environment.

There will be a strong equalizing effect that lower cost jurisdictions and workforces will have on economies. Developed countries may experience uncomfortable periods of deflation. Developing, business friendly jurisdictions will see outsized economic growth. This creates a wide range of investment opportunities spanning all human behaviors.

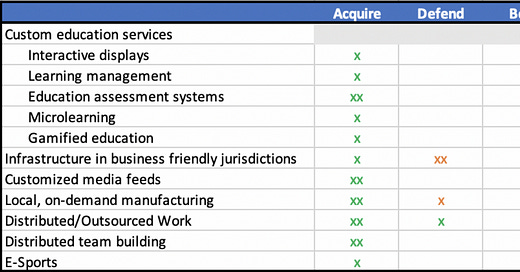

The table below is an example of potential investment opportunities and the corresponding demand sources. Green denotes demand now. Orange denotes demand later. “xx” denotes the dominant user motivation.

Education is an especially interesting sector. A high degree of information asymmetry provided institutions enormous power, a monopoly over reputation (degrees), and thus the ability to charge high prices. But with the transcendence of location and vanishing information asymmetry, education is ripe for change. We’re in the beginning stages.

Education is expected to grow to a $10 trillion industry by 2030 and the industry would be expected to add close to 100 million teachers. That is a massive resource requirement, and with interest in top level higher education falling rapidly, we will see a migration to lower cost, borderless solutions. Further, higher education has been massively subsidized; using the United States as an example, student loan debt sits at a staggering $1.5 trillion. Government intervention has artificially kept demand for traditional institutions afloat.

The progression in educational demand is straightforward. Scalable, online programs educate highly competitive workforces at a fraction of the cost. These workforces undercut the wages that were once expected from graduates of traditional institutions. Expected value of traditional education falls dramatically and almost all learning is driven to more efficient providers.

Theory of Change #2: Digital money is the foundation for global financial services

The creation of non-sovereign, digital money reduces the power of inflation and taxation. It also further reduces friction of global commerce. With the advent of Bitcoin, we saw a major governmental lever begin to dissolve. The follow-on effects are not yet obvious.

The fact is, Bitcoin reduces government revenue potential by providing a way to opt out of hyper inflationary forces and by altering taxation enforceability. With digital money, personal wealth becomes more difficult to seize and easier to transport. It further reduces geopolitical borders and allows the cybereconomy to flourish without gatekeepers. Bitcoin allows individuals to better defend. Defend against inflation. Defend against seizure. Defend against censorship. As these needs grow, so too will the value proposition of Bitcoin and ancillary applications.

This is another uncomfortable idea as a citizen of the United States. The USD seems infallible. But when growth slows, the first button nations push is the one that turns on the printing press. It’s happening as we speak. After weak attempts to tighten, money supply is rapidly increasing again. This view is not reserved only for Bitcoiners, libertarians, and gold bugs. Ray Dalio’s recent writings (here and here) echo this sentiment.

We’re seeing the beginnings of a fintech stack built to support natively digital money and exploit the benefits it provides. Currently, exchanges, custody, mining, and borrowing/lending are the leaders.

Bitcoin businesses can be separated into demand now and demand later:

Speculation (now) – Exchanges, funds, data providers, brokerage services

Defense (later) – Decentralized exchanges, self-sovereign custody, trustless payment products, fiat-to-Bitcoin on-ramps

Right now, the dominant use case for digital money is speculation (drive to acquire). Secondary demand comes from users defending against inflation, asset seizure, taxation or regulatory hurdles (drive to defend). Interestingly, the products that have most effectively delivered on speculative and censorship demands are Bitmex, Binance, and USDT. No wonder they have been so successful.

Exchanges are a good case study for thinking about market demand. Decentralized exchanges (DEX) were all the rage in 2018 but have seen limited adoption. We won’t see adoption of fully decentralized solutions until there is greater demand for regulatory arbitrage and dissent. That demand isn’t present today but with growing capital controls we will see migration to non-corruptible services.

Along similar lines, solutions that facilitate trust minimized on-boarding, custody, and commerce will become more important. I’m particularly interested in watching adoption trends of onramps like LocalBitcoins, payment services like opennode, BTCPay, and Zap, and key management systems like Casa.

With these products, financial services companies will finally be able to target billions of users around the world. Jill Carlson hits the nail on the head:

Theory of Change #3: Encryption enables dissident technology

Encryption reduces the cost of protection and decreases the leverage of violence. This enables significant power to move from the center and toward the margins (free markets). See this post from the FBI general counsel on why encryption is such powerful force and how governments are unable to stop it.

Continued recognition of vulnerabilities in infrastructure and applications, and the development of viable replacements, will lead to demand for an antifragile, censorship resistant, borderless webstack. I had been struggling to find a proper description for these “crypto” applications, and I think Maya Zehavi captures it perfectly with “dissident tech”.

Further, aggregators and public service providers are honey pots that have become targets for attack because there is an asymmetric reward profile.

Attack on corporation: Large Reward | Strong Security

Attack on individual: Small Reward | Strong Security (power of encryption)

However, this switch from centralized systems to distributed systems requires a fundamental shift in human behavior. We are used to outsourcing our security and protection. This is why we see limited adoption of crypto applications. It’s not just a scalability issue. It’s a demand issue. Our environment hasn’t yet warranted a behavior change but the undercurrents are growing.

More specifically, the demand for these distributed technologies comes from two angles:

Cost efficiencies – removing middle men can decrease predatory rent seeking. This is a marginal benefit and not powerful enough to force a switch.

Defensibility – These systems have the potential to be antifragile, safer, and censorship resistant (dissident). These are 10x improvements.

Consider the ability to run applications on a personal, encrypted single server (Urbit style), store your data locally, and get paid to share it through homomorphic encryption on an open market without the potential for data duplication. This would transform the incentives of internet companies who currently rely on data mining, it gives a huge amount of power back to the users, and it would generate countless new business models. The incentives to force this behavior change aren’t here yet, but they are coming.

Conclusion

Online education will continue to equalize workforces. Wages in developed countries will trend lower while wages in developing countries will grow.

Digital money is the catalyst for truly global fintech companies. The regulatory pushback will be intense but futile.

There is a growing need but not an imminent demand for dissident technologies. We have to focus on incentives and user demand.

The Sovereign Individual popularized many of these ideas in 1997, and they have begun to take hold. We are still in the early stages. I think the tipping point will be in the next 10 years. This framework only scratches the surface, and I plan to follow up with deeper research into each section.

Thanks to Nathaniel Whittmore, Ryan Yi, Christian Kaczmarczyk, and Jimmy Cofsky for feedback on this piece.